deductibility of up to 10% of the total declared income (Article 83, paragraph 2, Legislative Decree 117/17).

Home / Sostienici / COMPANIES

COMPANIES

Solidarity gifts for companies

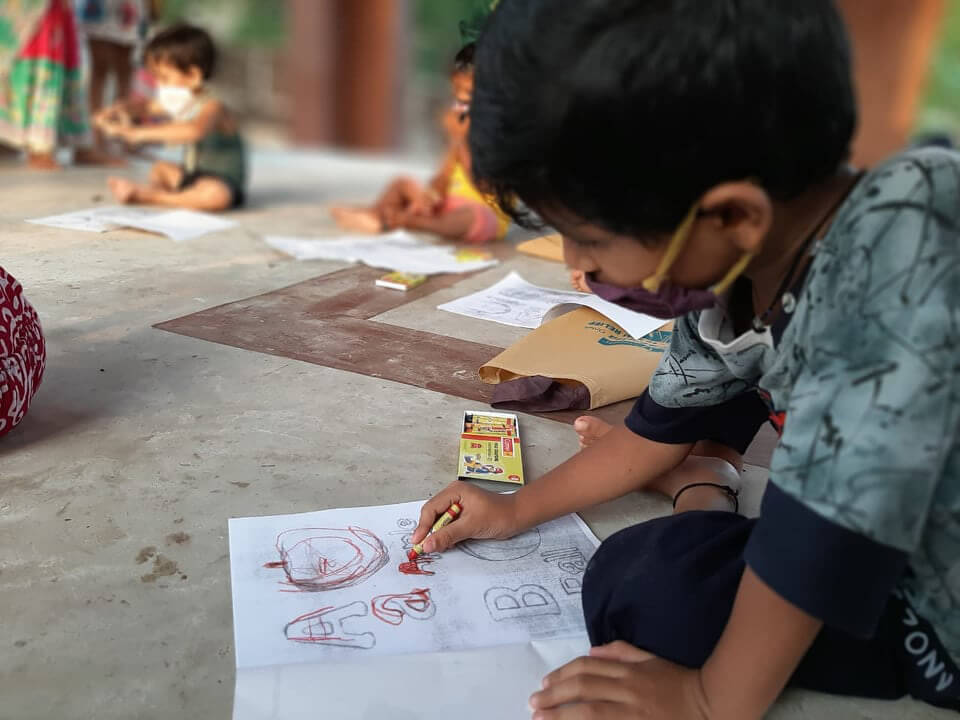

Saving the future of thousands of children is the kindest action. A small charitable gift can become a significant donation of food, education and medicines to those who need it more.

SOLIDARITY GIFTS

Tax Deduction

Donating gives you advantages too! Did you know that donations to a non-profit organisation provide tax benefits?

Both individuals and companies can deduct donations, and for individuals tax credit is also possible. You can include them in the income tax return to pay less taxes, as they reduce the taxable income. Keep the donation bank transfer receipt, credit card or postal current account statement.

Alternatively, based on the tax regime applied to liberal donations to NGOs, you have another option: deducting donations from your income for an amount not exceeding 2% of the total declared income (art. 10, paragraph 1, letter g of D.P.R. 917/86). For further information, you can consult your trusted advisor or visit the CAF (government office for tax assistance and information).

Company

Since January 2018, companies can benefit from:

NATURAL PERSON

From January 2018 natural persons can:

Da gennaio 2018 le aziende possono usufruire:

Partner

Since its foundation, Mission Calcutta has been able to rely on the valuable assistance and collaboration of various strategic partners.

We always extend our sincerest thanks to them for what we have been able to create together to change the lives of the people in need.

PARTNERSHIPS

A company that cares about life and a fair future for thousands of children is our ideal partner.

Together, we can create projects and partnerships that will enrich both the human experience and the image and activity of the company, that are in line with the company’s values.

These collaborations should be capable of generating the maximum social impact from an investment, such as lasting changes and saving lives.